“Whoever said money can’t buy happiness simply didn’t know where to go shopping”. Since currencies were invented, humans beings haven’t stopped shopping. Shopping has evolved over the years and barter has been replaced by debit and credit cards. Everything started with food and clothing; however, in the 21st century, basic needs go beyond that. Today’s bare necessities include food, clothing, shelter, communication, fashion, video games and of course, fast internet connection and a smartphone.

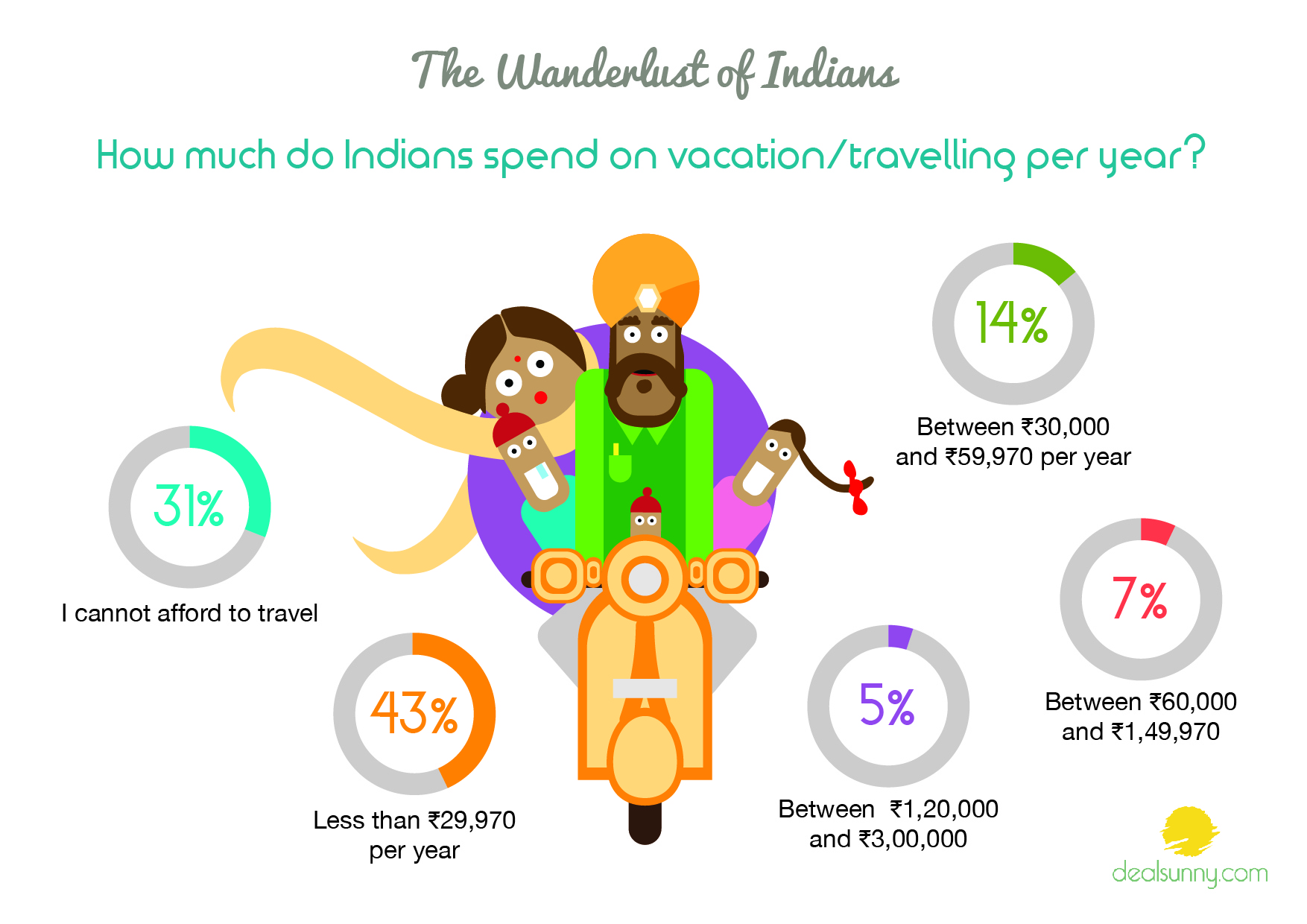

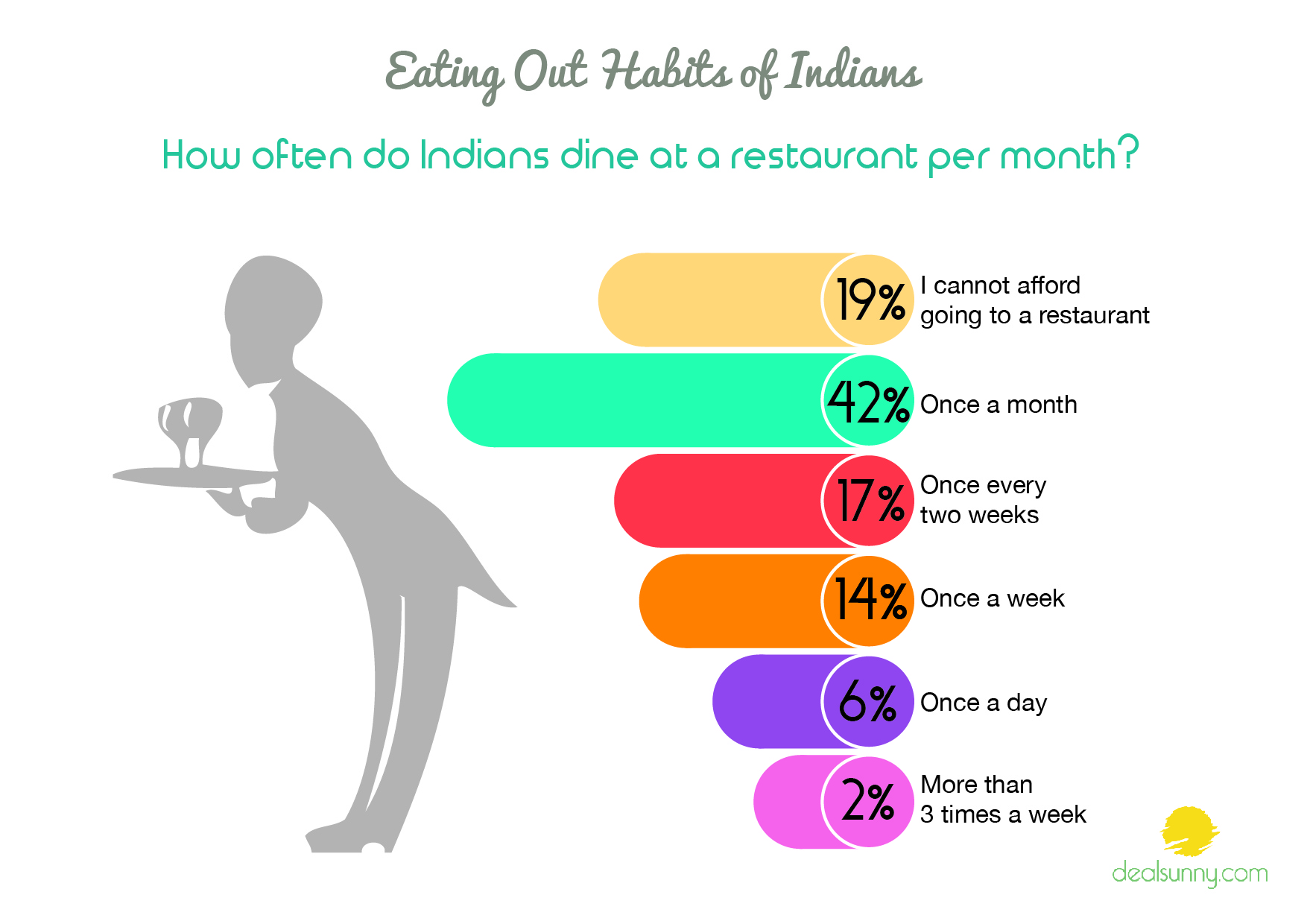

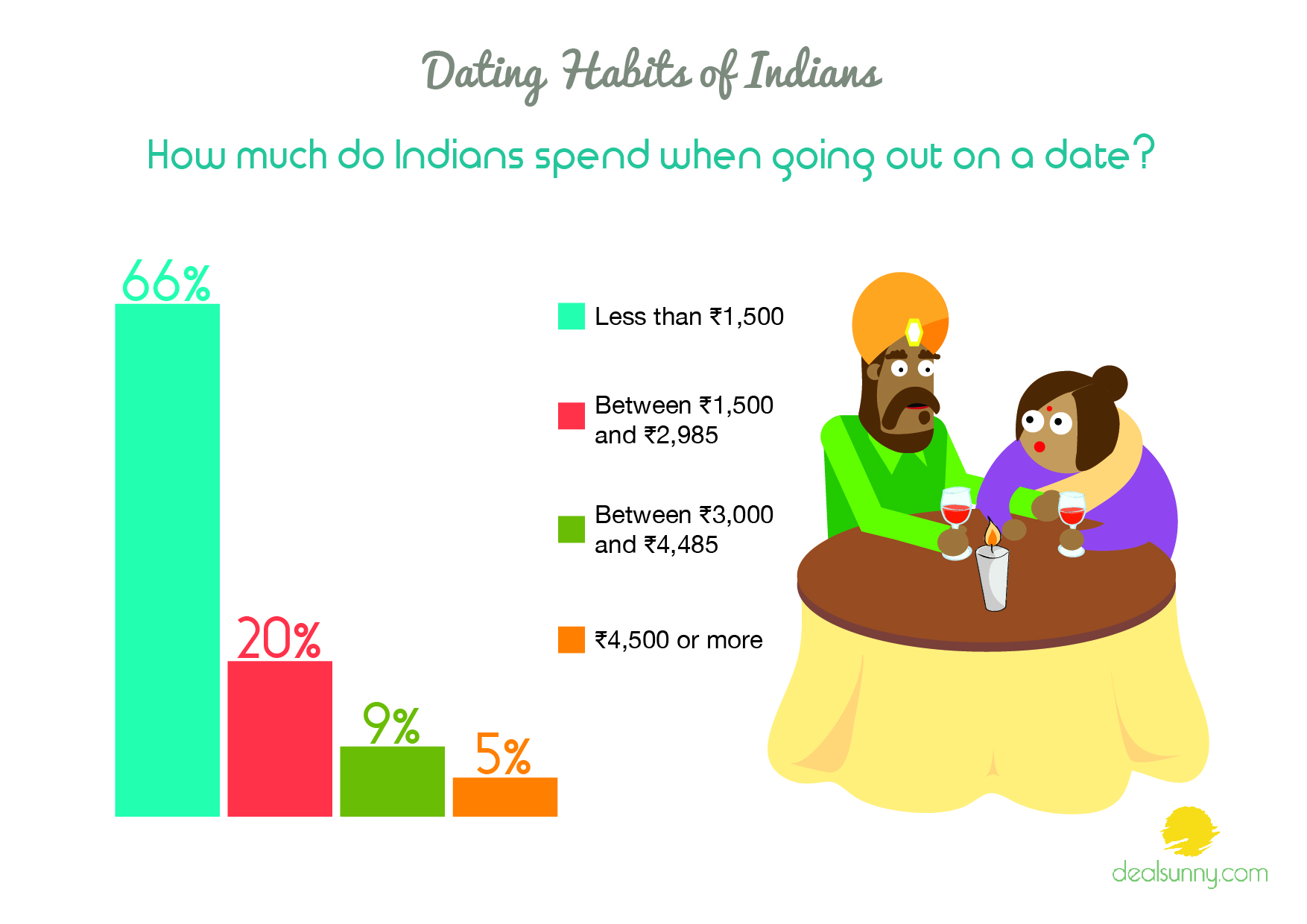

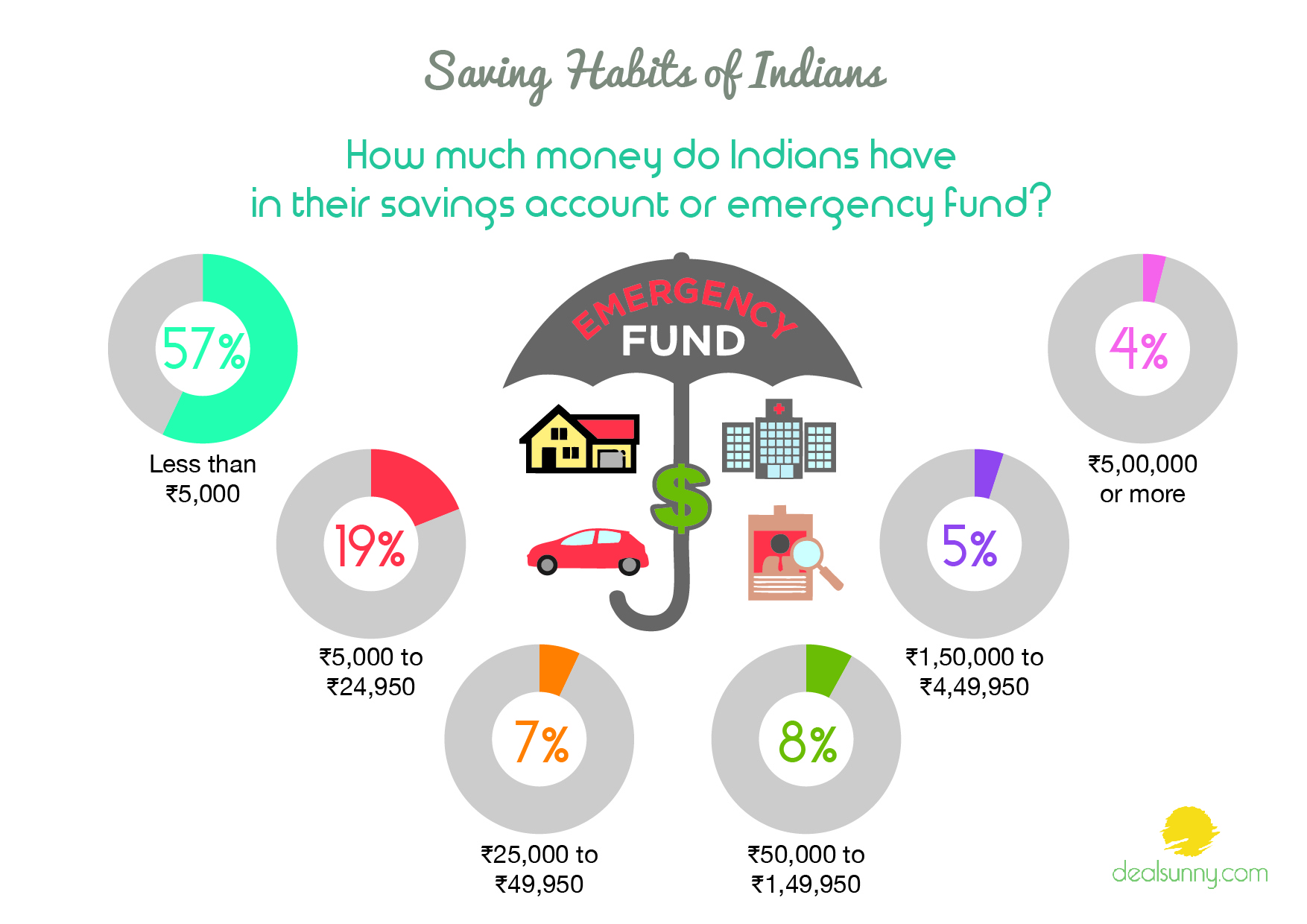

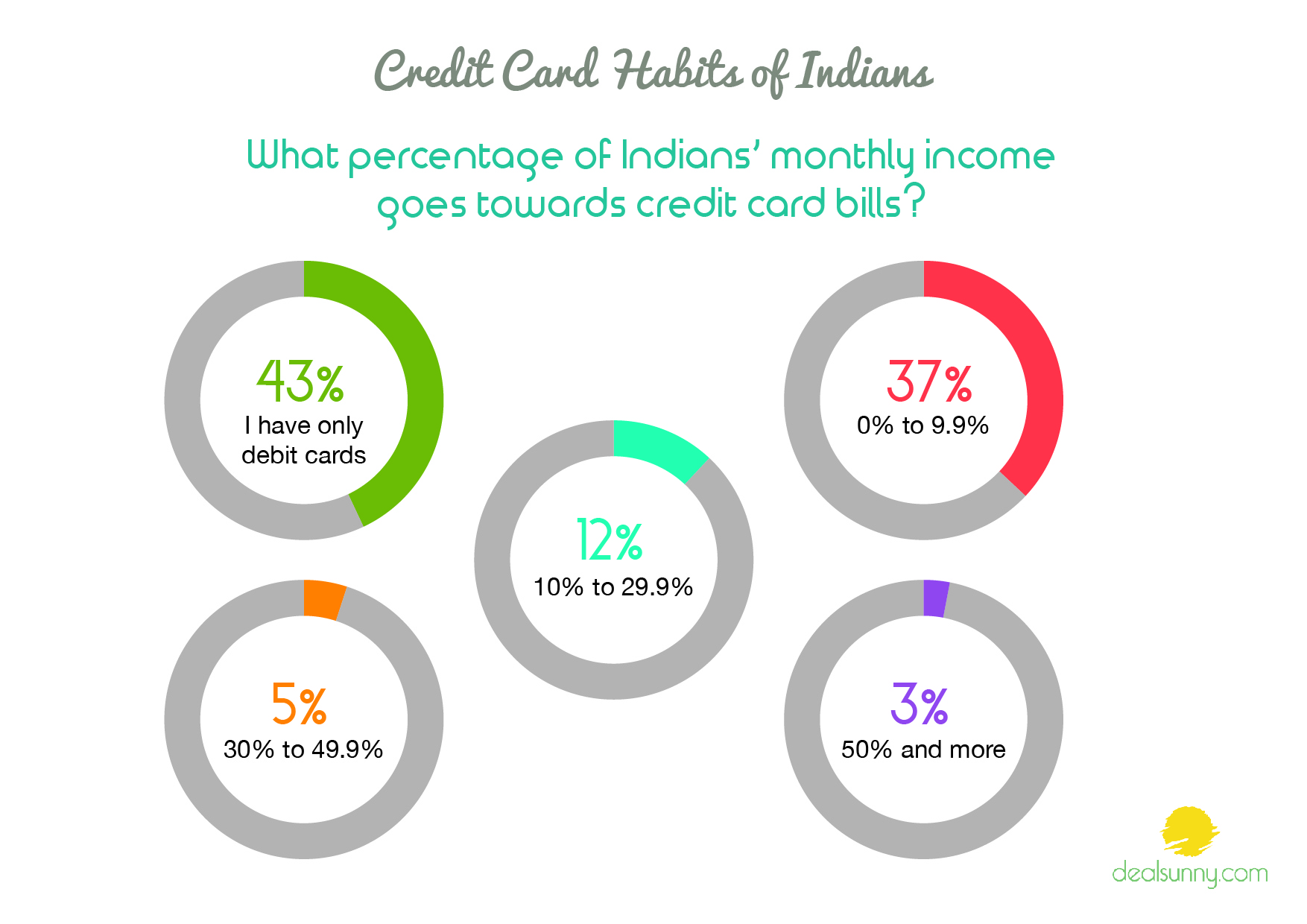

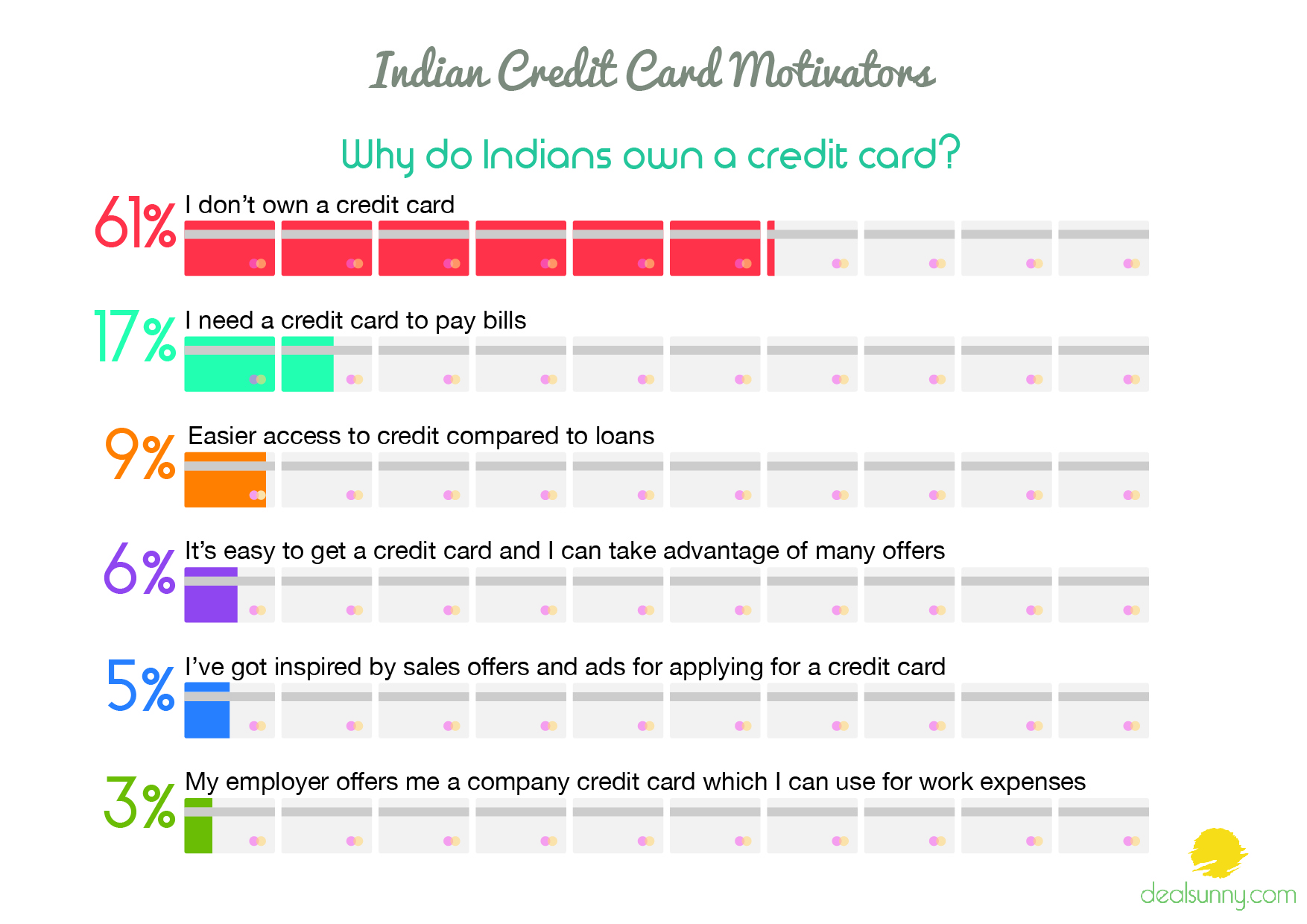

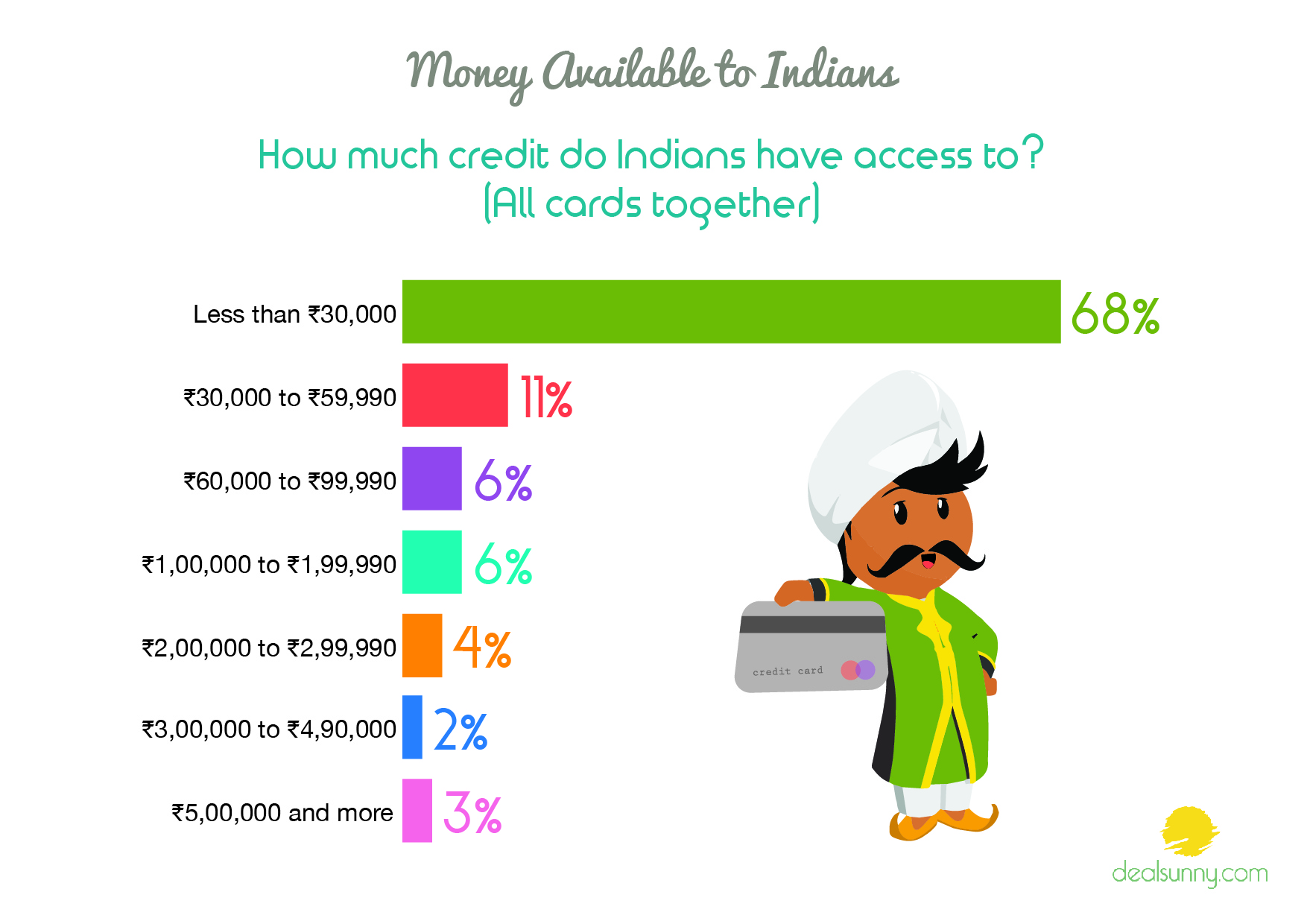

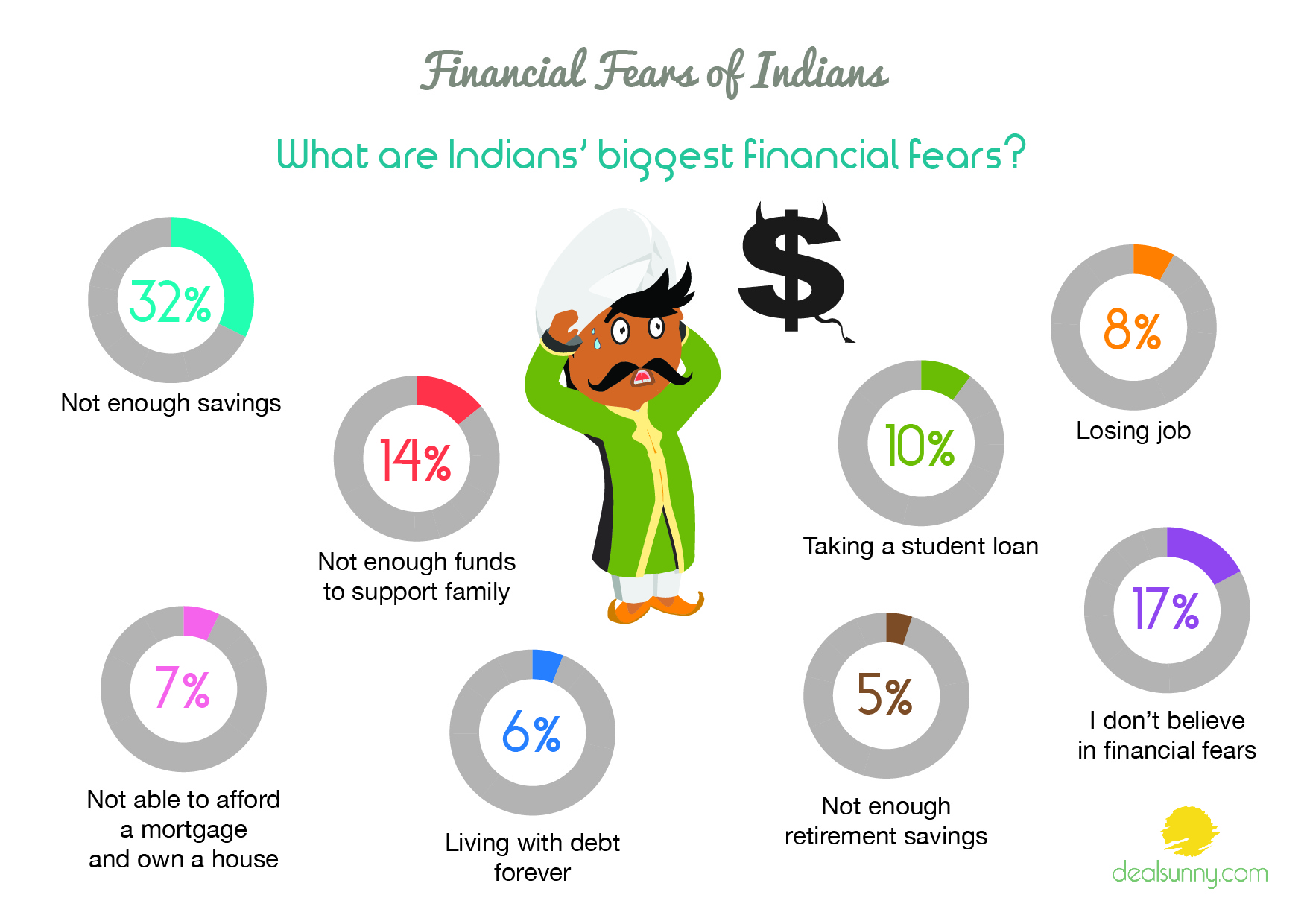

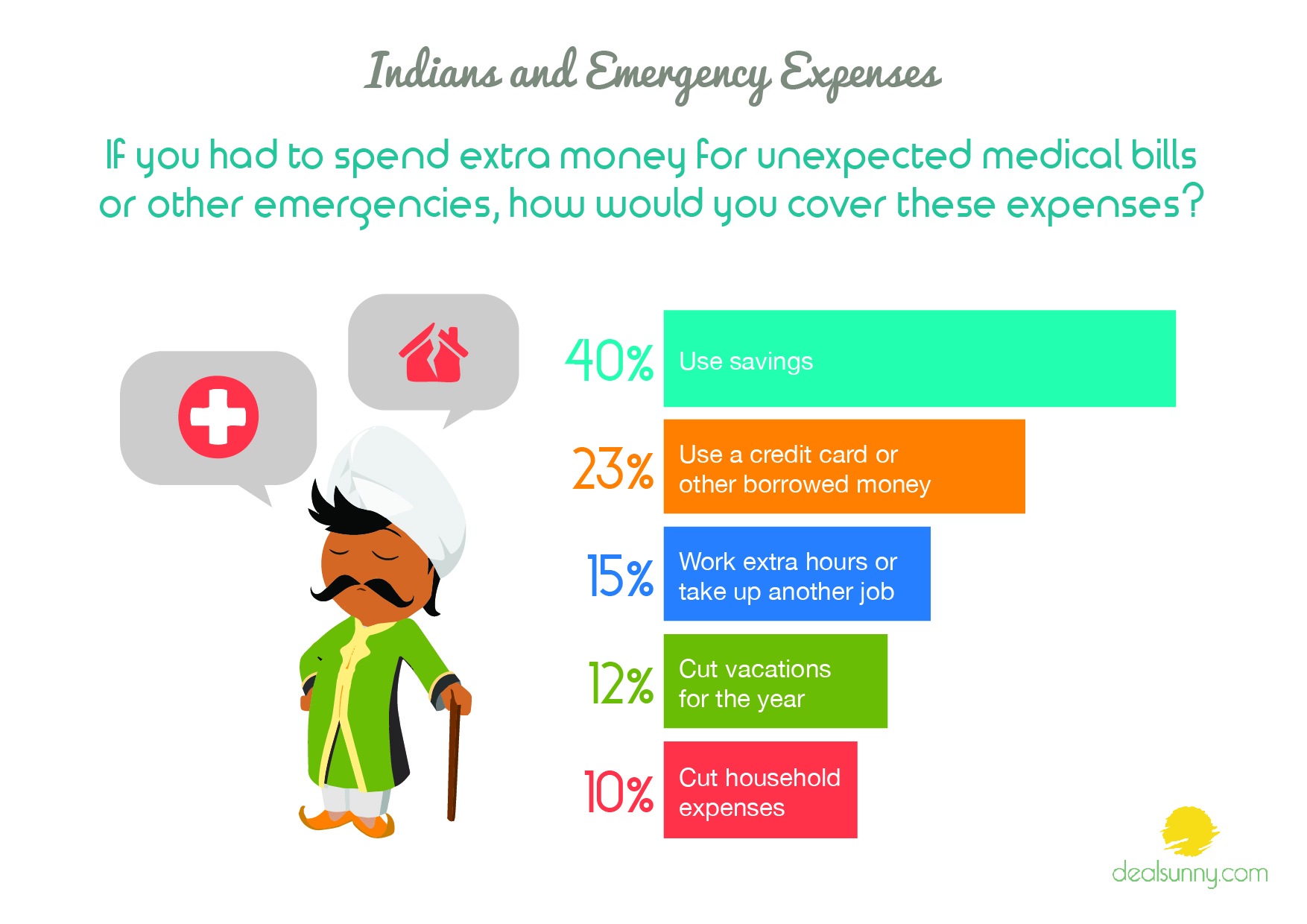

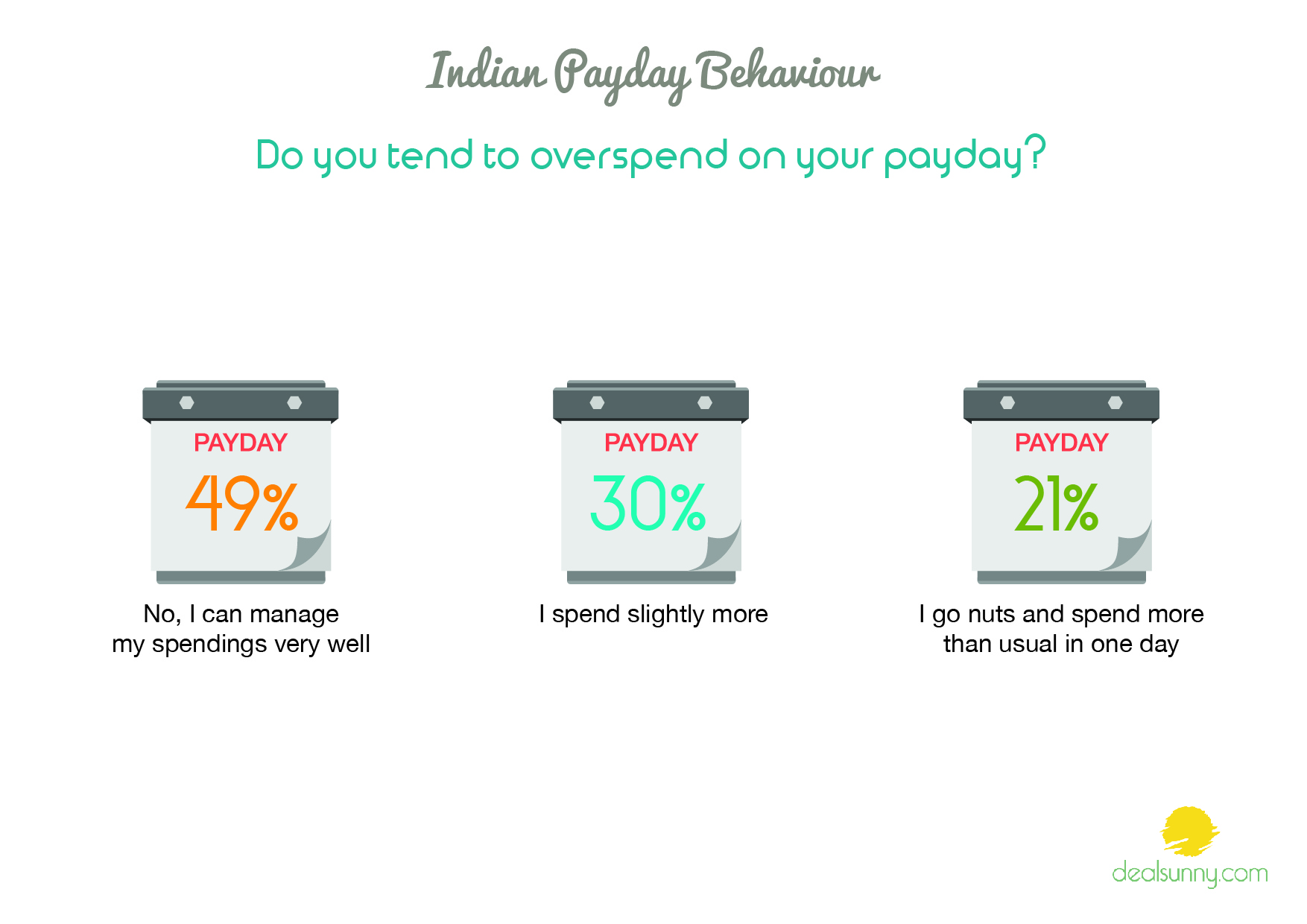

Indians are not very different from the rest of the world; they do spend large amounts of money getting goods and services on a daily basis. The question is: what are Indians spending their money on? DealSunny has done an extensive and very methodical study on Indians and their spending behavior in order to answer that question.

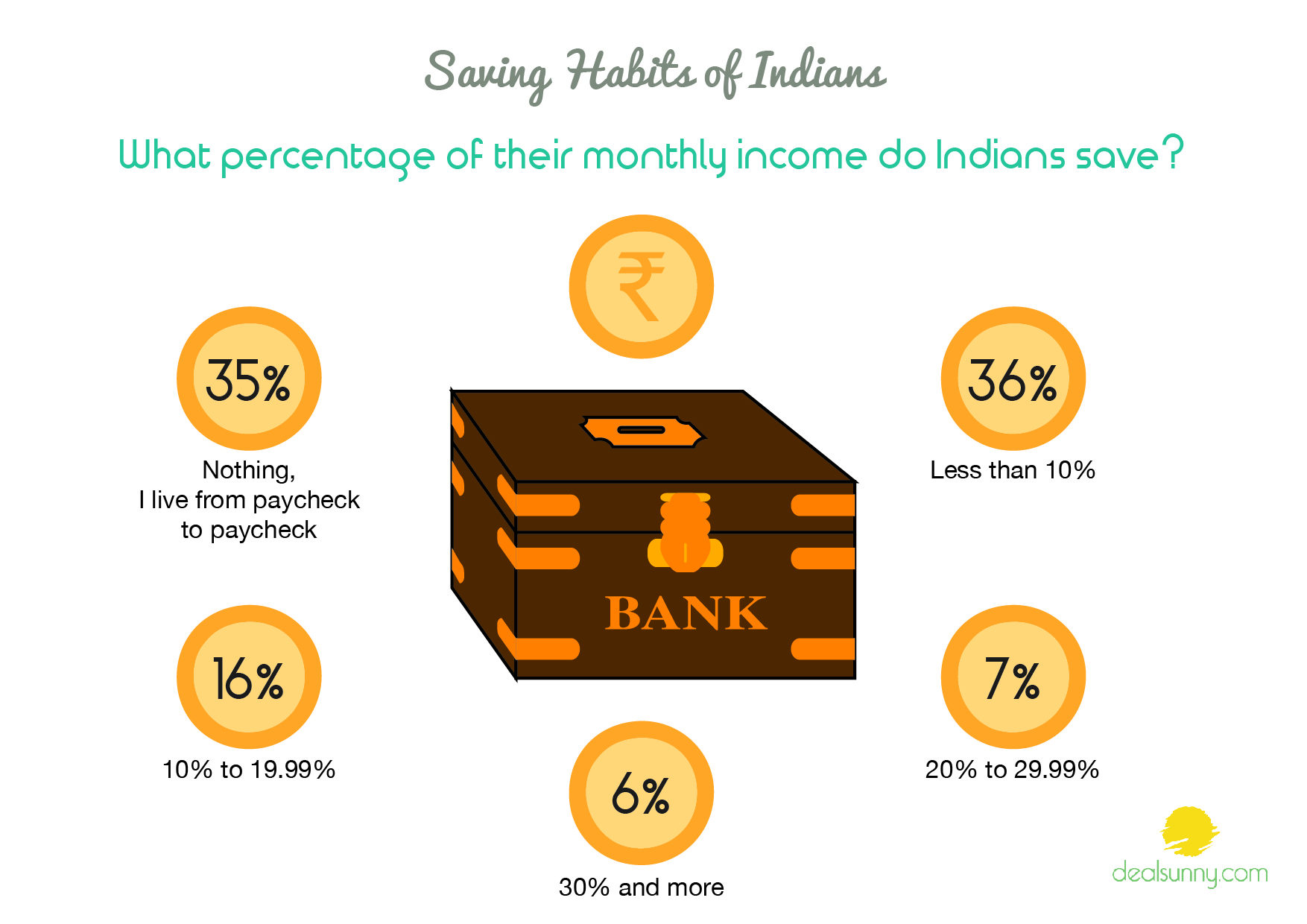

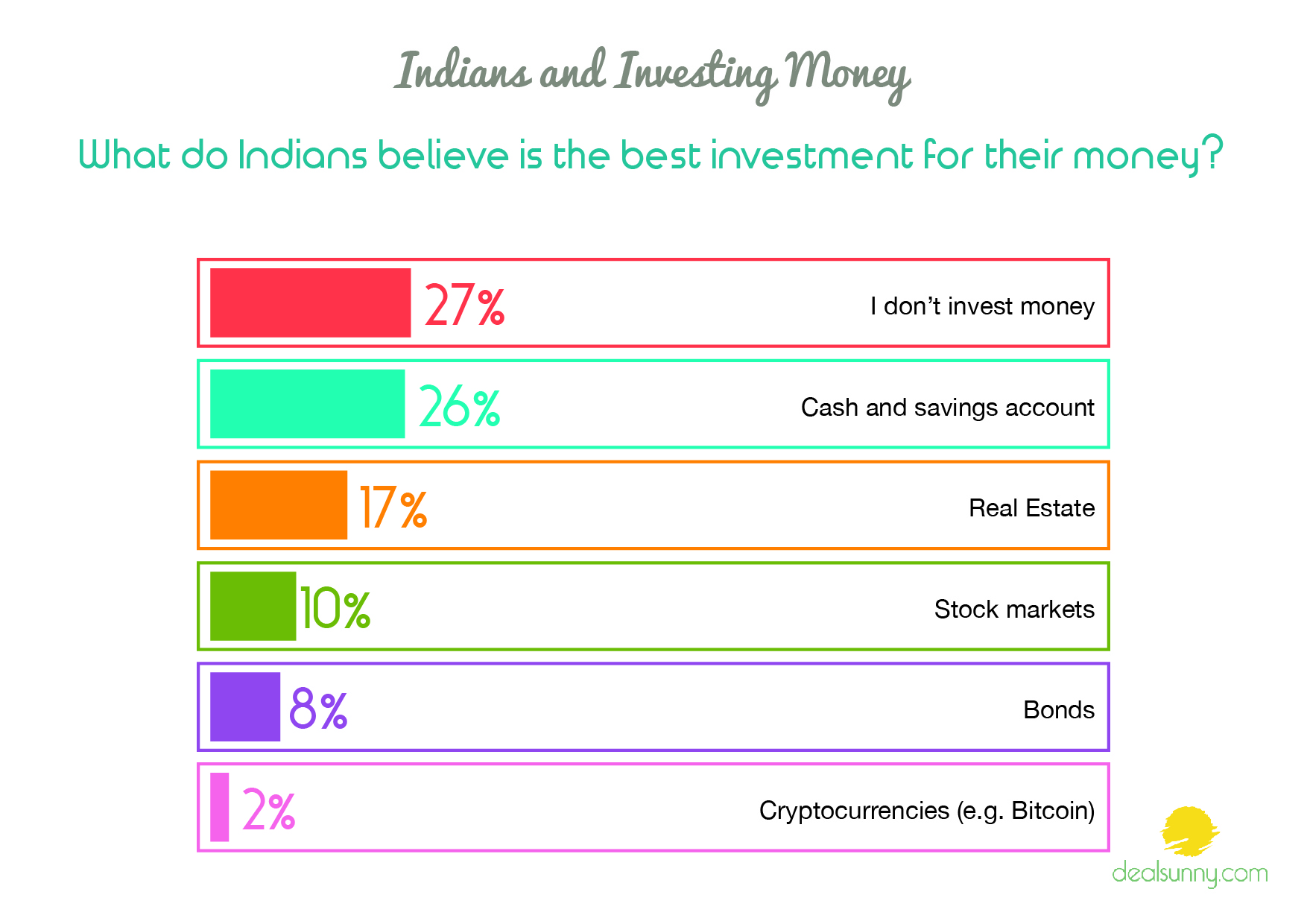

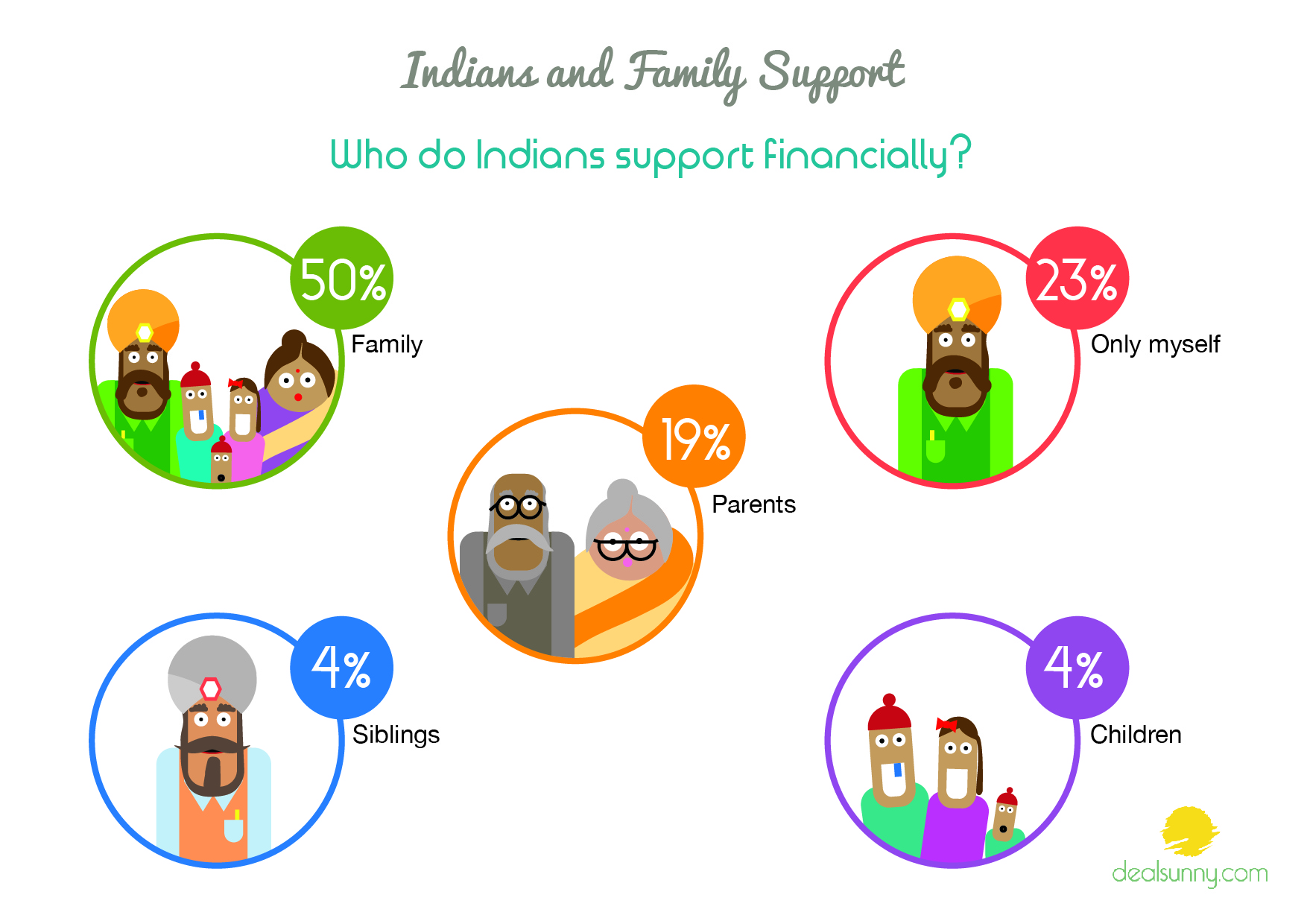

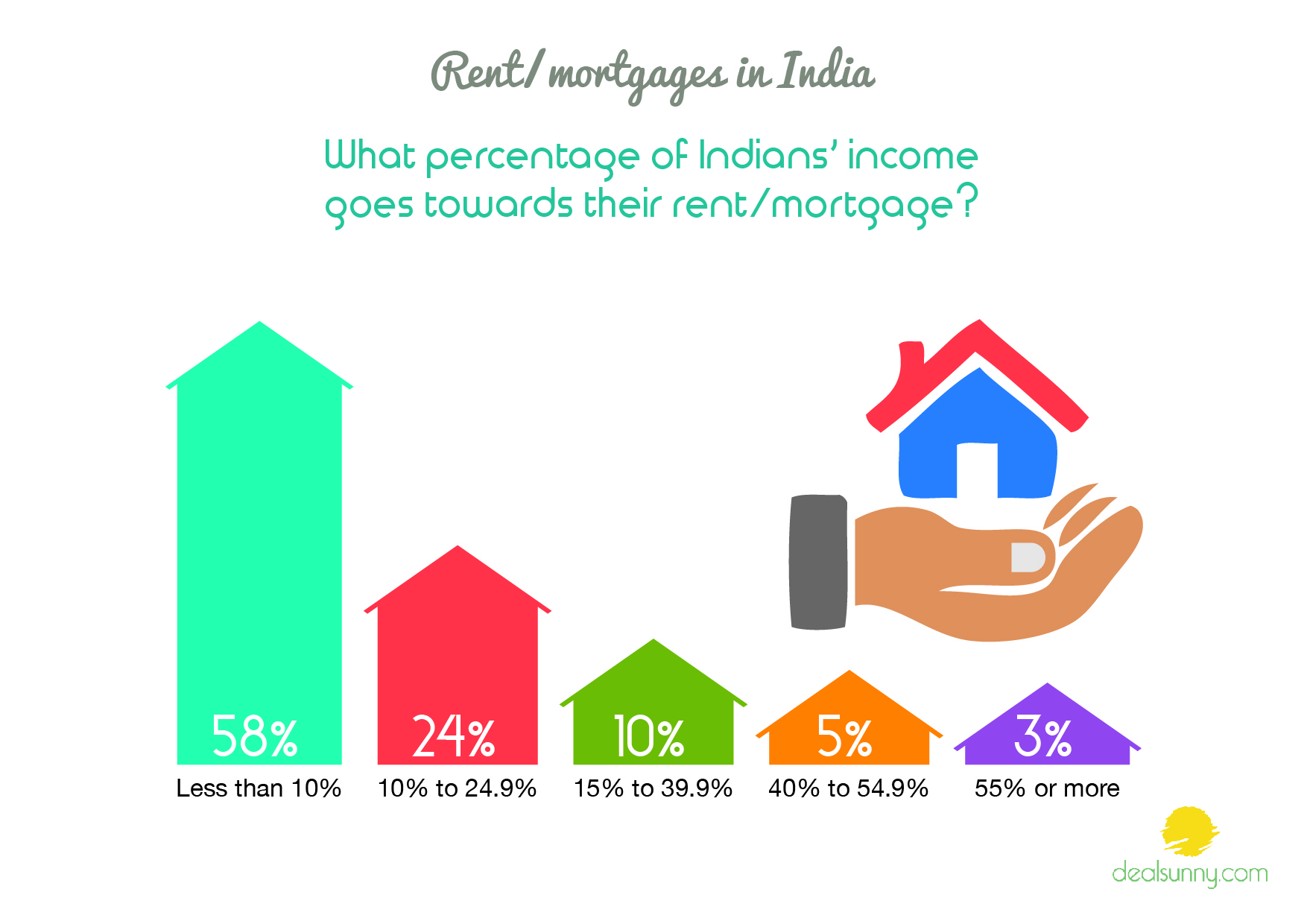

DealSunny’s “Spending Behaviour In India 2016” survey collects valuable information and analyzes fascinating statistics to discover what Indians are spending their money on. Likewise, this research gives insights into Indians’ bank accounts and evaluates their current financial situation. DealSunny’s Spending Behaviour In India survey reflects DealSunny’s dedication and love for India. The survey also helps Indians to get more information and knowledge about themselves and their society from a technical point of view.

The scope of the survey involved examining trends ranging from consumers' attitudes towards their shopping and spending behavior. Divided into numerous different categories, we bring to light how simple issues like marital

status or level of education can make a difference in Indians expenses. Shopping behavior involves many subjects from economic to psychological analysis, and DealSunny covered every single detail in this study.